Overview

As the tax season approaches, many of us start looking for ways to manage our taxes more efficiently. Today, I'm excited to share a few strategies for paying taxes and some tips on how to save money in the process. This article focuses on the IRS federal taxes.

1. Overpay Your Taxes Early and Wait for the IRS to Cut You a Check

One of the most straightforward and hassle-free methods is to overpay your withholding taxes throughout the year. When you file your taxes next year, the IRS will refund any overpayment.

For individuals, estimated tax payment comes due January 15th, with the return due April 15th. So a play that some people do is to overpay their taxes, and file for a refund.

Should you? The question depends on your specific situation as you essentially will have an opportunity cost difference during that time of how much money you overpaid versus keeping that money in your wallet.

Another method seen discussed before is to overpay on an extension. File and pay the extension close to April 15th, then file the return a few days (or weeks) later.

Before executing any of these strategies, we do recommend to talk to a CPA who can advise you on the specifics of what is possible or not.

2. Pay with Credit Cards and VGC

Maximizing Your Paycheck While increasing withholding taxes ensures a hefty refund, it also reduces your take-home pay. Utilizing credit cards to pay your taxes can be a strategic move, especially for those looking to meet spending requirements on new credit cards and earn rewards.

Paying Taxes with Credit Cards

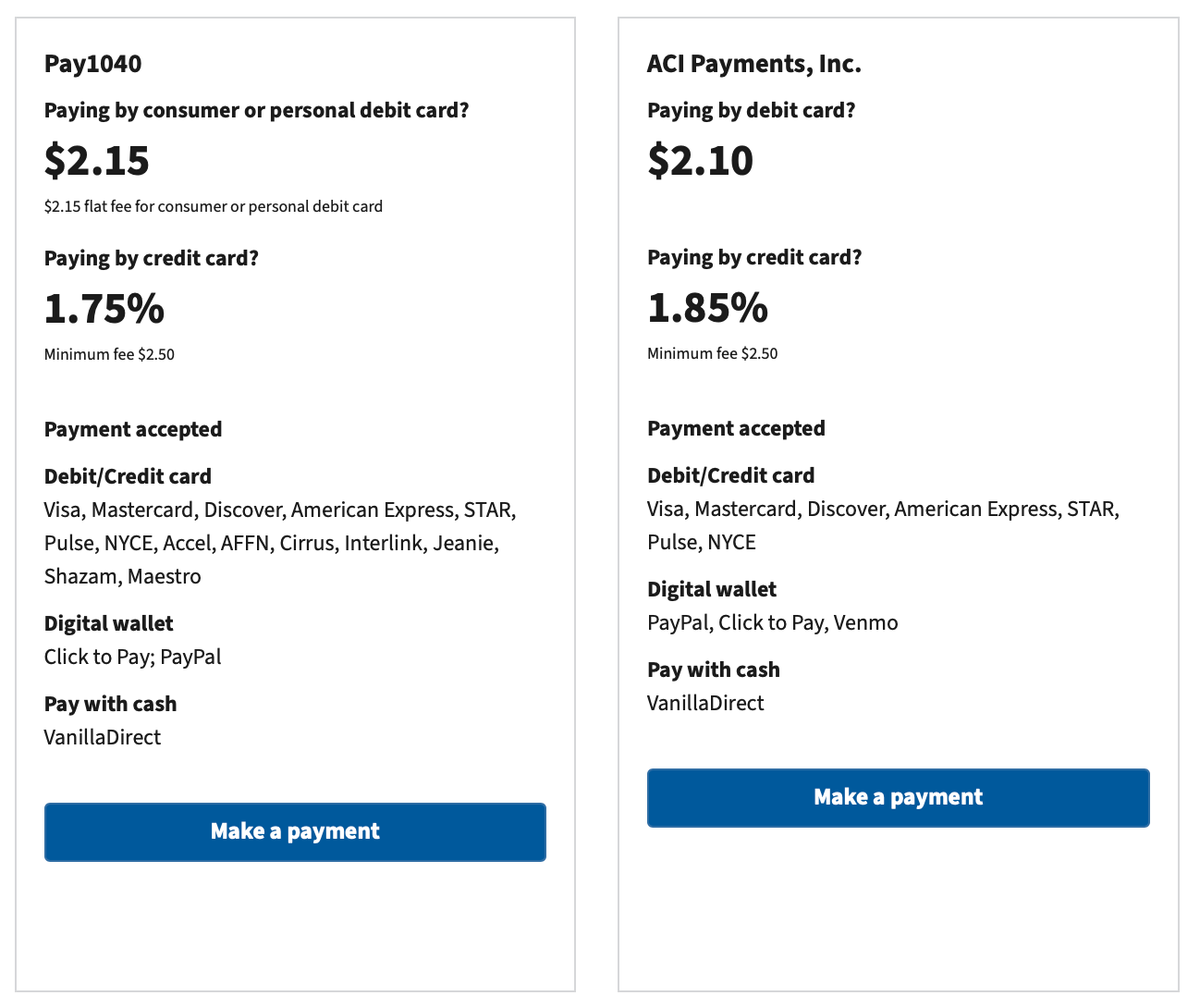

To pay your taxes via credit card, you must use one of the two IRS-designated payment processors. Currently, Pay1040 offers the lowest fee at 1.75% for consumer cards. However, be aware that using business credit cards and Amex now incurs a higher fee of 2.89%! For more details, check out this article: Pay1040 Fees Update. When making a payment, select “Form 1040 Current Year Tax.” You can make up to two payments per processor annually, totaling a maximum of four payments per year.

Credit Cards and Fees Overview

Visa: 1.75%

MasterCard: 1.75%

Amex/PayPal (Visa): 2.89%

ACI Payment (Amex): 1.85%

The convenience fee for consumer/personal debit cards is $2.15.

Potential Concerns and Advanced Strategy

What if you've already filed your taxes and want to make additional payments? You can indeed pay more, and the IRS will eventually refund any overpayments, though it will significantly slow down the process. If you overpay substantially or repeatedly, it might raise suspicions at the IRS, especially if you're already due for a refund.

To manage this, consider adjusting your W4 to decrease tax withholdings, allowing you to keep more money from each paycheck while transitioning from receiving a tax refund to owing taxes—which you can then pay with a credit card. However, this carries risks; insufficient withholdings could lead to under-withholding penalties. Ensure you pay enough estimated tax quarterly to avoid penalties.

Changing Your Withholding Settings

You can adjust your withholdings using the IRS’s Tax Withholding Estimator: IRS Tax Withholding Estimator. Note: The site is under maintenance from December 31 to January 15. After estimating your taxes:

Submit a new Form W-4 to your employer.

If your income includes RSUs, subtract any under-withheld amounts as RSUs typically have insufficient withholding.

For income types such as referral bonuses, short-term capital gains, and dividends which aren't typically withheld at source, ensure to account for these in your tax calculations.

Frequency of Payments: Each processor allows up to two payments per year, totaling up to four payments annually.

Advanced Strategy: Adjust your W4 to reduce tax withholdings from your wages. This will increase your paycheck amounts but may require you to owe more taxes at year's end, which you can then pay via credit card. However, this approach carries risks—if you under-withhold and fail to pay sufficient 1040 ES, you might face penalties.

Special Considerations:

If you receive RSU income, it's often under-withheld. Make sure to account for this in your calculations.

For income types without withholding, such as referral bonuses, short-term capital gains, and dividends, ensure these are factored into your taxable income estimates.

If your tax situation is complex or you are a high-income individual, base your estimates on previous tax returns to avoid underestimating your tax liability.

List of Credit Cards That Can Earn Points:

Discover Debit

Upgrade Debit

BoA Unlimited

BILT

Chase Hyatt

C1 Venture/X

CIP, CIC

Citi Premier

VGC, MGC

Other 2% Cashback Cards

If you are considering using Visa Gift Cards (VGCs) for tax payments, Simon Mall offers $1000 denomination VGCs which are ideal for this purpose (Avoid purchasing these with an Amex card, as you will not earn points.) For detailed steps and tips on bulk purchasing Visa Gift Cards from Simon Mall, you can refer to the comprehensive guide: Simon Mall Visa Gift Card Online Bulk Ordering: Everything You Need to Know.

Other VGCs and MasterCard Gift Cards (MGCs) Gift cards that allow for zip code registration generally have better online support. For reference:

MGCs with the number 5128 might be used on both ACI and Pay1040.

Pathward MGCs with the number 4118 cannot process payments on ACI, but are accepted on Pay1040.

MGCs numbered 5456 smoothly process tax payments on ACI.

Our end recommendation is probably the safest method is using something such as Citi Double cash and combo-ing it for another +1.8%. Historically online it seems that most people have had success with it.

Obviously everyone’s situation will differ and things may change every year, so we encourage always to double check if the way you plan to pay has any data points of success online.

3. Paying Taxes with Kasheesh (Untested & Unverified)

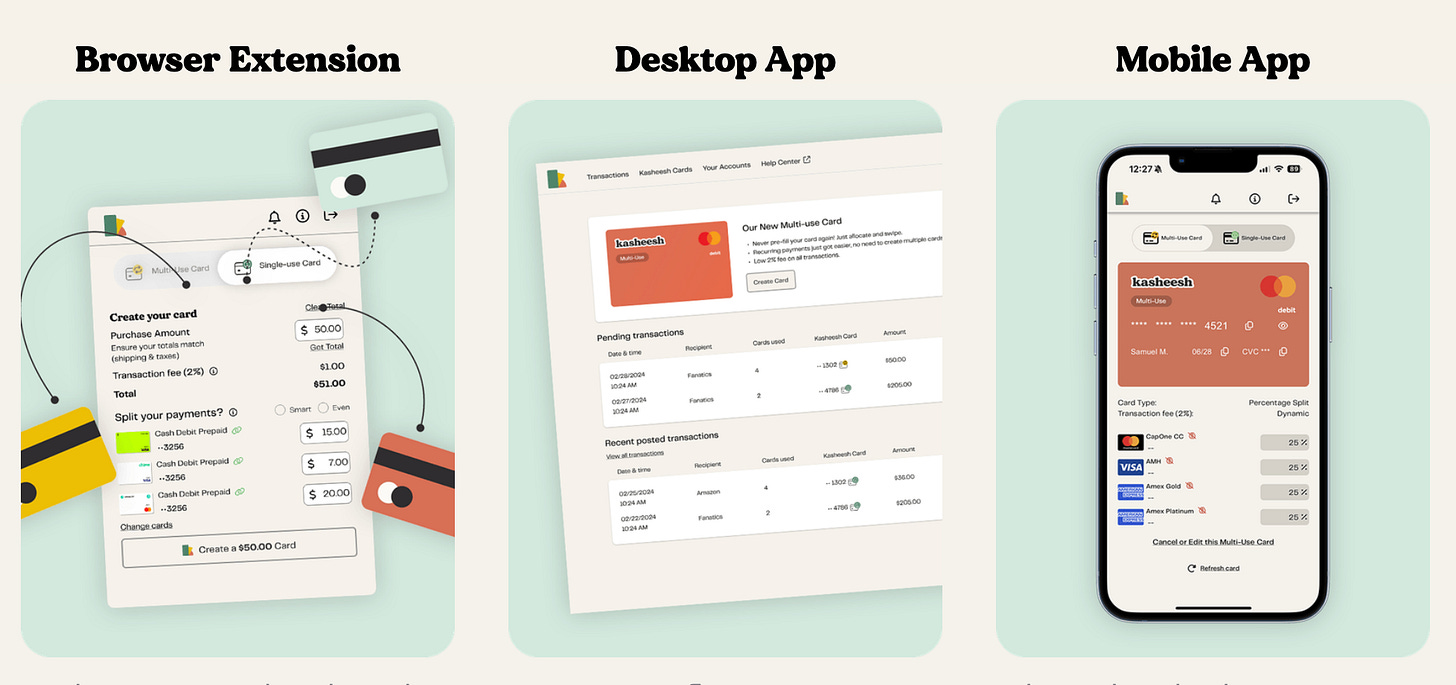

Kasheesh offers a unique solution for those looking to optimize their tax payments. This platform allows you to split any payment, including tax payments, across multiple cards. You can use a combination of credit cards, debit cards, and prepaid gift cards, or you can choose to utilize just one underlying credit card. The flexibility to distribute the payment across up to five different cards can be particularly beneficial for maximizing rewards or meeting spending thresholds on multiple accounts.

How Kasheesh Works: Kasheesh functions as a digital debit card, which typically incurs only the lower debit card transaction fees, rather than the higher fees associated with credit card payments. However, it's crucial to note that Kasheesh generally charges a 2% transaction fee for its services. To avoid this fee and enhance cost savings, look out for and plan your tax payments during Kasheesh’s “no fee” promotion periods, which waive this usual charge. Depending on your situation, it could even still be worth it to you without the fee waiver.

Potential Advantages:

Cost-Effective Payments: By incurring only the debit card fee and avoiding the credit card fees, you can reduce the overall cost of your tax payments.

Maximizing Rewards: Splitting your tax payment across several rewards-earning cards can help you optimize the rewards from different card issuers.

Points to Consider:

Reliability: As Kasheesh is relatively untested and unverified in the context of tax payments, but the fact that they have an article on the subject suggests it should be possible. Note though that it could fail as Kasheesh as a payment method is not accepted everywhere.

Promotion Timing: Staying informed about Kasheesh’s promotional periods can significantly reduce your expenses. Keep an eye on their announcements or subscribe to updates to make the most of the no-fee opportunities.

![[MS Series Bonus] How to use the T****s Debit card Tutorial](https://images.unsplash.com/photo-1483706600674-e0c87d3fe85b?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wzMDAzMzh8MHwxfHNlYXJjaHwyfHxzZWNyZXR8ZW58MHx8fHwxNzM1MjMwNjQ1fDA&ixlib=rb-4.0.3&q=80&w=1080)

Ended up just using BoA PRE (2.62% (x1.25 if stars align) at 1.75% cost) and (mostly) Paypal master card (3% at 1.85% cost (from ACI. Pay1040 would have cost 2.89%)). I would have done all Paypal mastercard but would have needed to credit-cycle which I was unsure whether that was advised against for Synchrony card. (*cries in usb smartly-denied*)

Decided NOT to meet SUBs with fed taxes since that Paypal MC had a category-like advantage here. Meeting SUBs on other spend that have even playing fields - like state taxes and property taxes.

A Kasheesh data point: I had a fed tax payment using Kasheesh rejected today. I emailed their support to ask about limits and they wrote:

```

Please take a moment to review your account's key spending parameters:

1) Daily Spending Limit: A maximum of $15,000 can be transacted across all your linked cards each day.

2) Linked Card Limits: You may link up to 5 cards to your Kasheesh account. • Each linked card has a daily spending cap of $3,000.

3) Transaction-Specific Limits:

a) Utility Transactions: $1,000 per transaction.

b) Retail Transactions: Fall under the overall $15,000 daily limit.

c) Wholesale Transactions: $5000 per transaction

d) Tax Payment Transactions: $5000 per transaction (Suggestion is maximum of $4500 to ensure the transaction fee and $2.50 Service Fee goes through without issue).

4) Plaid-Connected Accounts: For cards connected via Plaid, the $3,000 per-card limit is lifted. Your spending limit aligns with your actual credit limit on each connected card. The overall $15,000 daily limit remains in effect as an additional security measure.

These carefully structured limits are in place to safeguard your financial activities and maintain the integrity of our platform. They reflect our commitment to providing you with a secure, reliable, and efficient service.

```

At least (3d) seems to be new. I did a $14,900.00 tax payment in Sept 2024.