High Deposits, Higher Rewards: How to Earn Up to $3,000 with Simple Bank Account Setups

Deposit larger amounts and get huge bonuses – a few clicks could mean thousands!

If you have some extra savings and want to earn significant rewards, this post is for you! We'll walk you through the latest bank account sign-up bonuses with high deposit requirements—perfect for those willing to keep a larger balance in their accounts for a few months. In this article, we will go over the latest high deposit requirement bank account sign-up bonuses. These bonuses are generally larger, but they require higher deposit amounts, ranging from $30,000 to $250,000. You’ll generally need to keep the funds in the account for about 90 days before you can receive the bonus. If you don’t have that much spare cash, don’t worry! You can always check out our previous article on How to Make 2k with Checking Accounts in 3 Months, which features accounts with lower deposit requirements that are perfect for beginners.

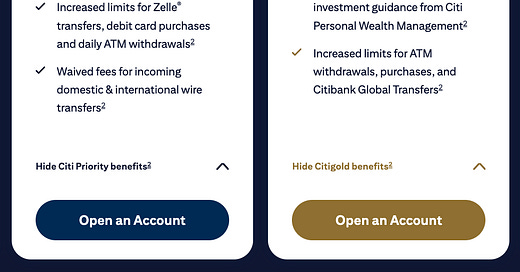

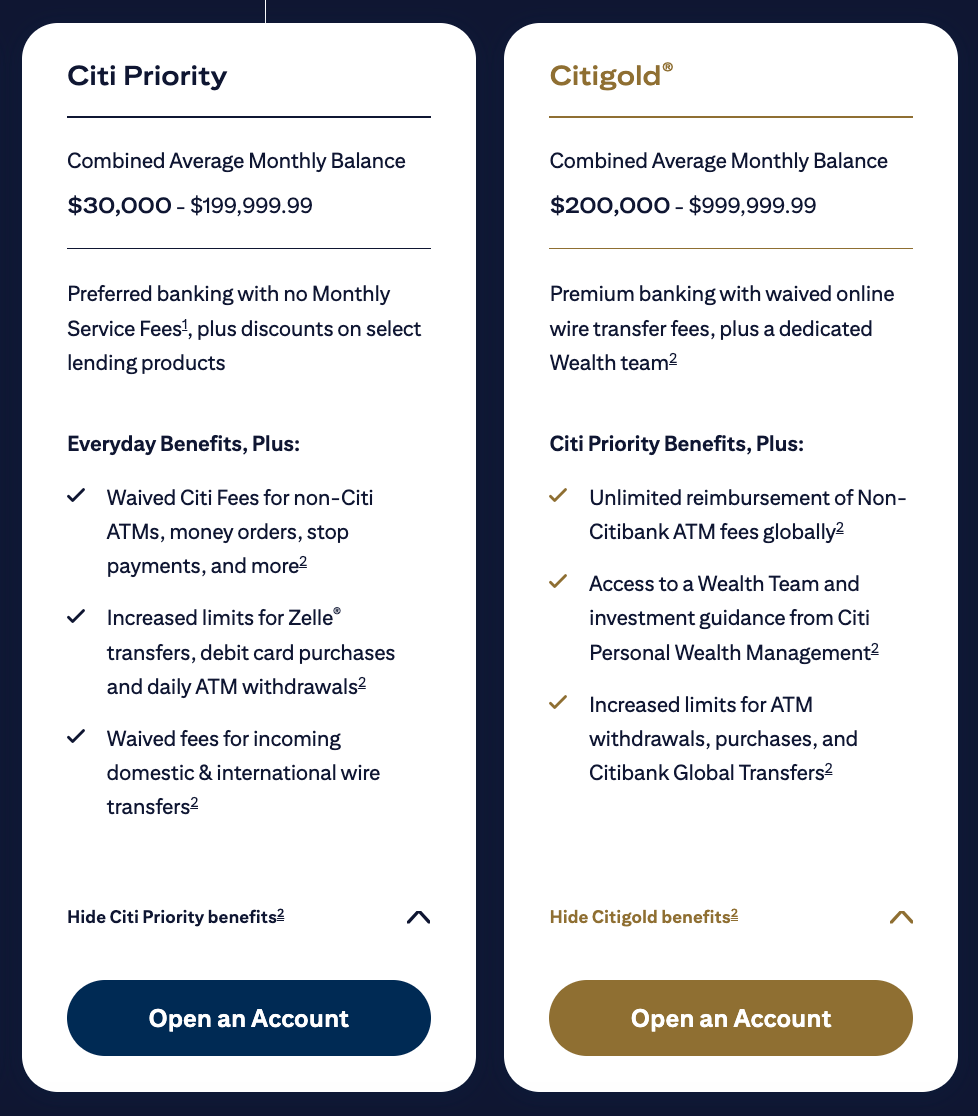

Citi Priority/Citigold: $500/$1500 Bonus

Account Overview

$500 Account Opening Bonus! Offer valid until January 22, 2025.

Citi Priority Monthly Fee is $30. You can avoid the monthly fee if you maintain an average monthly balance of $30,000 or more across all Citi accounts (including checking, savings, and investment accounts).

Citigold has No Monthly Fee, but you must maintain a balance of $200,000 or more to keep the Citigold account.

There is no Early Termination Fee so you can close the account anytime.

Account Opening Bonus Requirements

This bonus is available only to new customers. Existing Citi Checking account holders or those who closed a Citi Checking account within the last 180 days are not eligible. Having a Citi credit card does not affect your eligibility for this bonus.

Within 20 days of account opening, deposit a specified amount and maintain that balance for at least 60 days from the 21st day. The bonus corresponding to each deposit amount is as follows:

Only the funds in this checking account will count toward the bonus. Funds in savings or other accounts will not be considered.

Capital One 360 Performance Savings: $300/$750/$1500 bonus

Account Overview

$300/$750/$1,500 Account Opening Bonus when you use promo code BONUS1500. This is the best bonus available for this account. See conditions below.

No Monthly Fee.

There is no Early Termination Fee, so you can close the account at any time.

The Annual Percentage Yield (APY) is consistently competitive. As of November 2023, the APY is 4.30%.

Account Opening Bonus Requirements

This bonus is available only to new users. If you have or had an open 360 Performance Savings, 360 Savings, 360 Money Market, Savings Now, or Confidence Savings account since January 1, 2022, you are not eligible for this bonus.

Within 15 days of opening the account, you must deposit the required new money (new money refers to funds not previously held in Capital One accounts). The bonus for each deposit amount is as follows

You must maintain the deposit amount for 90 days to qualify for the bonus.

Chase Private Client: $1000/$2000/$3000 Bonus

Account Overview

The bonus requirements are to transfer the following amounts of new money within 45 days and maintain that balance for 90 days:

Chase Private Client (CPC) Benefits

Wealth Management Services: The primary purpose of Chase Private Client is to provide access to JP Morgan's wealth management services. You pay a management fee for them to handle your investments.

Enhanced Credit Card Sign-Up Bonuses: For example, if you're a CPC, your Chase Sapphire Preferred (CSP) or Chase Sapphire Reserve (CSR) card could have targeted offers up to 60,000 points, compared to the standard 50,000 points for non-CPC.

Banking Fee Waivers and Benefits:

Monthly fee $35, monthly fee waived if the balance is more than $150,000

No non-Chase ATM fees. Chase will refund fees from other banks' ATMs up to 5 times per statement period.

Free Online Stock and ETF Trades with You Invest by J.P. Morgan.

No domestic or international wire transfer fees.

No stop payment fees.

No foreign transaction fees (on debit card).

No debit card replacement fees.

Free Safe Deposit Box: Get a free 3×5 Chase safe deposit box.

Mortgage Rate Discounts:

For assets between $250k and $1M, you get a 0.125% mortgage rate discount.

For assets over $1M, you get a 0.25% mortgage rate discount.

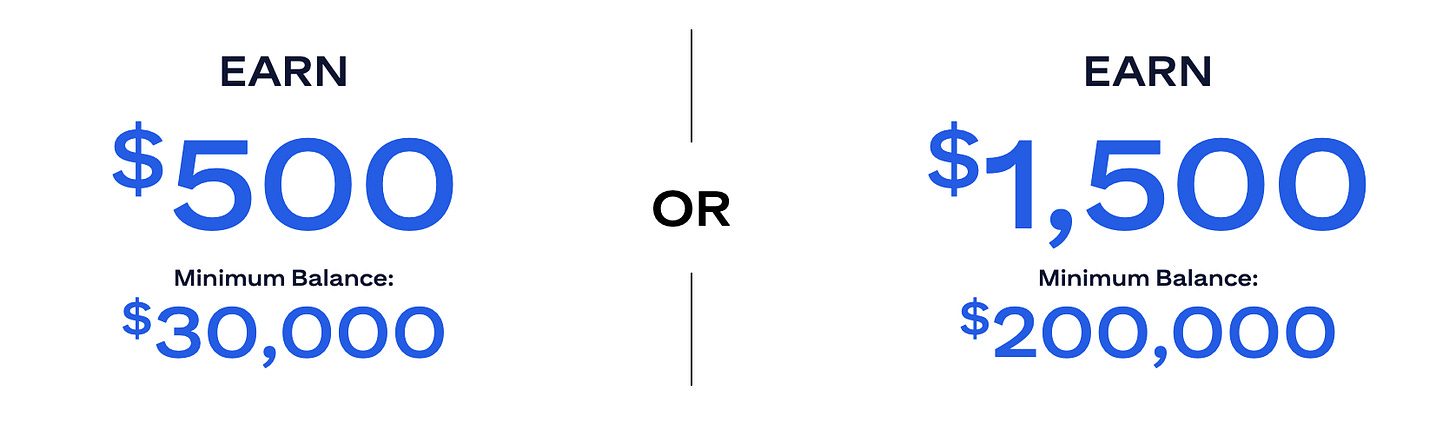

Wells Fargo Premier Checking: $2,500 Bonus

Account Overview

$2,500 Account Opening Bonus! Offer valid until January 7, 2025.

Monthly Fee: $35. To avoid the monthly fee, you must maintain a balance of $250,000 or more in Wells Fargo qualifying linked accounts.

There is no Early Termination Fee, so you can close the account at any time.

Account Opening Bonus Requirements

If you have received the sign-up bonus for this Premier account within 12 months, you cannot receive it again.

Top up at least $250,000 to qualifying linked accounts within 45 days of account opening. Qualifying linked accounts include checking, savings, CDs, brokerage, etc.

Maintain a balance of at least $250,000 for 90 days.

HSBC Premier: $1500/$2500 Bonus

Account Overview

Open an account, deposit $100k or $250k within 20 days, and maintain this balance for at least 3 calendar months to receive a $1,500 or $2,500 bonus. This money does not necessarily need to be in the checking account—it can be placed in an investment account as well.

Early Termination Fee: If you close the account within 180 days, there’s a $25 early termination fee.

Wire Transfer Fees: There are no fees for both incoming and outgoing wire transfers, including international wire transfers. This makes this account especially valuable for those who frequently make international transfers.

Monthly Fee: $50. To waive this fee, you need to meet one of the following requirements:

Maintain an average monthly balance of at least $75,000

Or have at least $5,000 in monthly direct deposits (HSBC has relatively loose direct deposit requirements; you can refer to this DoC page for more information).

The balance requirement includes all combined checking, savings, and investment accounts.

⚠️ Important Note: This opening bonus is only available once in a lifetime.

Friendly reminder: Be sure to leave at least $1 in your checking account. If you transfer all the money to a savings account, your checking account will be automatically closed after 30 days, and you won’t qualify for the bonus.

If you have the funds available, these bank accounts offer an excellent opportunity to earn substantial opening bonuses while enjoying a range of premium financial services. From accounts with no monthly fees to bonuses as high as $3,000, and exclusive benefits like wealth management services and fee waivers, these accounts present valuable options for those looking to make the most of their banking.

Before opening any of these accounts, make sure you meet the deposit and balance maintenance requirements to ensure you can fully qualify for the bonuses. Whether you’re looking for higher savings rates or more comprehensive banking perks, these high-reward accounts are worth considering.

I hope this article helps you find the best account for your needs. If you have any questions or would like more information, feel free to leave a comment below, and let’s discuss further!