Part 1: What is and How to do Manufactured Spending

Part 1: Explaining what manufactured spending is at a high level for those unfamiliar.

Community and Notes

Read my ToC for how to join the community’s discord and get more help!

DISCLAIMER: NOT FINANCIAL ADVICE. Doing anything is at your own risk and can cause closures / shutdowns of your bank accounts. Please determine your own risk level and tolerance if you do this.

Overview - The first steps

My goal is to create a strong mental model for you so that you understand this before you get into it.

This is the first part in a series of guides covering MS since there are many layers and nuances from what it is, to how to do it, to optimizations. I will naturally have all the articles linked together for what is relevant so you don’t need to go hunting for it.

If you are just starting out / trying to learn what is manufactured spending this is where you should be starting.

Please note, I highly recommend to join the Discord for paid members!! This game changes and information updates, and the Discord is the best way to stay on top of it

Terminology

Let’s first establish the premise of manufactured spending, which is about exploiting bank accounts, debit cards, and primarily credit cards to get rewards. This also makes the activity primarily US-based, where the credit card reward system is well-developed and widespread.

Credit cards offer two main benefits:

SUBs (sign up bonuses): where if you spend a certain amount of money in a period of time when you first open a card, you get a bonus in points or cash.

Points / Cash back for spending: such as a credit card might say you get 4x points back for dining. So if you spend, 100 dollars, you get 400 points. And depending on the bank, usually lets you convert those points at 1 cent-per-point (cpp), meaning you effectively get 4% back.

Churning: Where you repeatedly open new credit cards to earn sign up bonuses.

The problem is that not everyone can “organically spend” (your natural spending pattern) the amount required to get a SUB. Example an Amex business Platinum highest SUB offer is 250K points (2.5K USD reward) for 20K spend in 3 months. This is a high ask and basically impossible for most individuals.

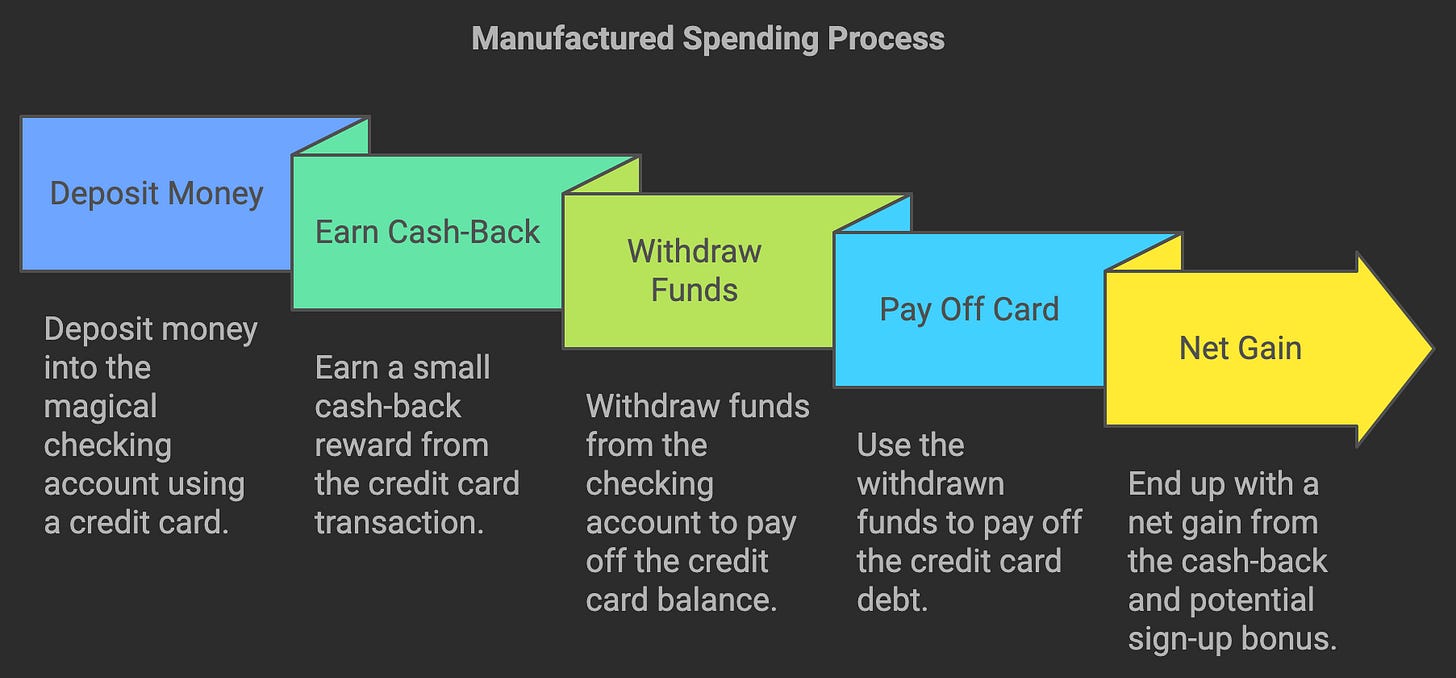

Instead to meet this requirement, the goal is to do manufactured spending where we “fake-spend” money to hit these spending reward categories. We’ll go much more in depth in later articles on multiple concepts on how to do it, but a very super high-level explanation is:

Imagine there is a magical checking account you can deposit money using a credit card (cc).

Let’s say you spend 100 dollars on your credit card to deposit 100 dollars to this “magical checking account”, with a 2% cash-back on the CC, meaning you got $2 dollars; and owe -100 dollars on the card.

You can now withdraw money from this checking account to pay off your card, meaning you are left with $2 dollars and in addition on your way to get the SUB for your card.

Note: Some people ask isn’t this a cash advance? Which no - the method of manufactured spending goal is to find things that count as actual spend and not as a cash-advance (since cash advance usually won’t get you points + have high interest on it).

What I want to emphasize for you to take away though is that the objective is convert your credit card spend to “cash” to pay off your card. So that you effectively are left with just the cash back.

As a fun fact - if you open up a US Bank checking / saving account, they actually do let you deposit money on initial funding using a credit card! (There are other banks that allow you to do this too). The problem is this method is not long-term scalable, meaning its more of a one-off tool than a long term tool.

Why do this? / Costs?

Well, not only are the points redeemable for cash at 1 cpp, but you can usually get much higher value at 1.35cpp - 2cpp (depending on the bank / type of point), and even significantly more when redeeming for business class flights or hotels.

Maybe that $10,000 dollar trip wasn’t possible with your own money, but maybe you could generate $1 million points (10K USD) with only 2K to 3K USD) instead. So essentially by using credit card points we are able to leverage our money to go multiple times further.

What are the costs associated with this? The exact cost breakdown is hard to say, b/c it completely depends on your strategy, but you do need to consider things like: being able to pay the annual fee on your card (if there is one), waiting for the points to post at the end of the month after your credit card statement, so-on.

So if you have absolutely zero-wiggle room, I actually DO NOT RECOMMEND this hobby or game. You really do need to be able to absorb and front some cost just due to natural time delays as you get paid out, and also most of the time you will be getting the most value in “points”. Meaning most people actually shouldn’t want to cash-out unless if necessary. (Which definitely does happen! I myself for example for a 4K USD plane ticket for me and my partner together, I cashed out the points necessary to pay for it! But I did it understanding it was un-optimal and did it just due to the holiday season.) But what it meant is that I was holding the value in points rather than cash directly in my bank account b/c I didn’t urgently need it.

There are people though who do look at this as a way to purely make money, and that is fine. Just again know, that there is a relative small cost you will need to float as you wait for points to pay out.

The nice thing about this game though is there is a very defined input and output. So you will tend to know the front cost / the cost of the entire play is calculable before you begin.

Common Concerns

Is this legal?

The first question to answer is obviously is this “legal”. And the short-answer is yes. This falls into a grey area in the financial system, but in general, you won’t be in legal trouble though banks can choose to stop working with you.

This is why this game is built upon datapoints (DPs) where people community source information together. (And why if not already, should join the Discord found at the top this article). By community sourcing information, people can share what is safe, what is not safe, and try to come up with ideas together.

There is actually a case by the IRS who tried to sue a couple who made 300K USD in cash-back and the couple (mostly) won.

What is the tax implications?

Cashback / Points are NOT TAXABLE!! This is also what makes the hobby great. B/c it is considered a “rebate” these rewards you collect are actually not taxable and means you don’t need to file a tax report at the end of the year. (Can Google “Are credit card points taxable”)

Obviously, make your own decision though. Some people who do this do decide to report at 1 C

Won’t this hurt my credit score?

There are multiple layers to this so let’s tackle them one by one.

Hard inquiries: Whenever you make a credit card, most banks will do what is called a “hard inquiry” to your credit report. Which can temporarily ding your credit score by 10 ~ 20 points, but these usually recover quite fast. For example, I’ve opened up 5-6 cards within 3 months, and my score dropped from a 750 to a 738, and is currently on the way back up.

While your average credit card age will go down, this is not the end of the world. Actually having more credit cards earlier on in life (if you are on the younger side) is better so that your future weighted credit card age will be better. If it is something that gets dangerously low though, you can also get added as an authorized user to a family’s credit card to take advantage of a family’s member longer history and help average that out. Being added as an authorized user makes it look as if you had a card for as long as your family member. And this is actually also how I help keep my average age up.

Opening up business credit cards, other than the initial hard inquiry, biz cc don’t report to personal credit. What this means is that while there is an inquiry to your report, it won’t actually show up at all as a personal credit card, thus not hurting your average credit card age. This is actually why a popular strategy in the manufactured spending (MS) community is to do business credit cards since a lot of banks won’t report to personal credit. (Always do research to confirm this but usually the major banks will not).

What if I don’t have a business

In this game, you will usually be what is called a sole-proprietor, which means that you are the business entity. You are actually implicitly this if you ever tutor, day-care, mow someone else’s lawn so on. And you can also have a business that doesn’t make money. Maybe you just opened up a tutoring business a month ago, but have no students yet, so on.

You don’t actually need to have a full on fledge business that is making money.

Common Traditional Methods

I’ll now be covering some traditional methods in manufactured spending. I am not saying to do these methods, as there are actually even more efficient and easier methods that I’ll explain in a different article.

The objective though is to explain to you a simple starting point, and to explain to you the “traditional methods” (that still do work) to help introduce various concepts to you and so that you can begin to think about different “loops” / “strategies” of your own.

Prepaid Visa and Money Orders

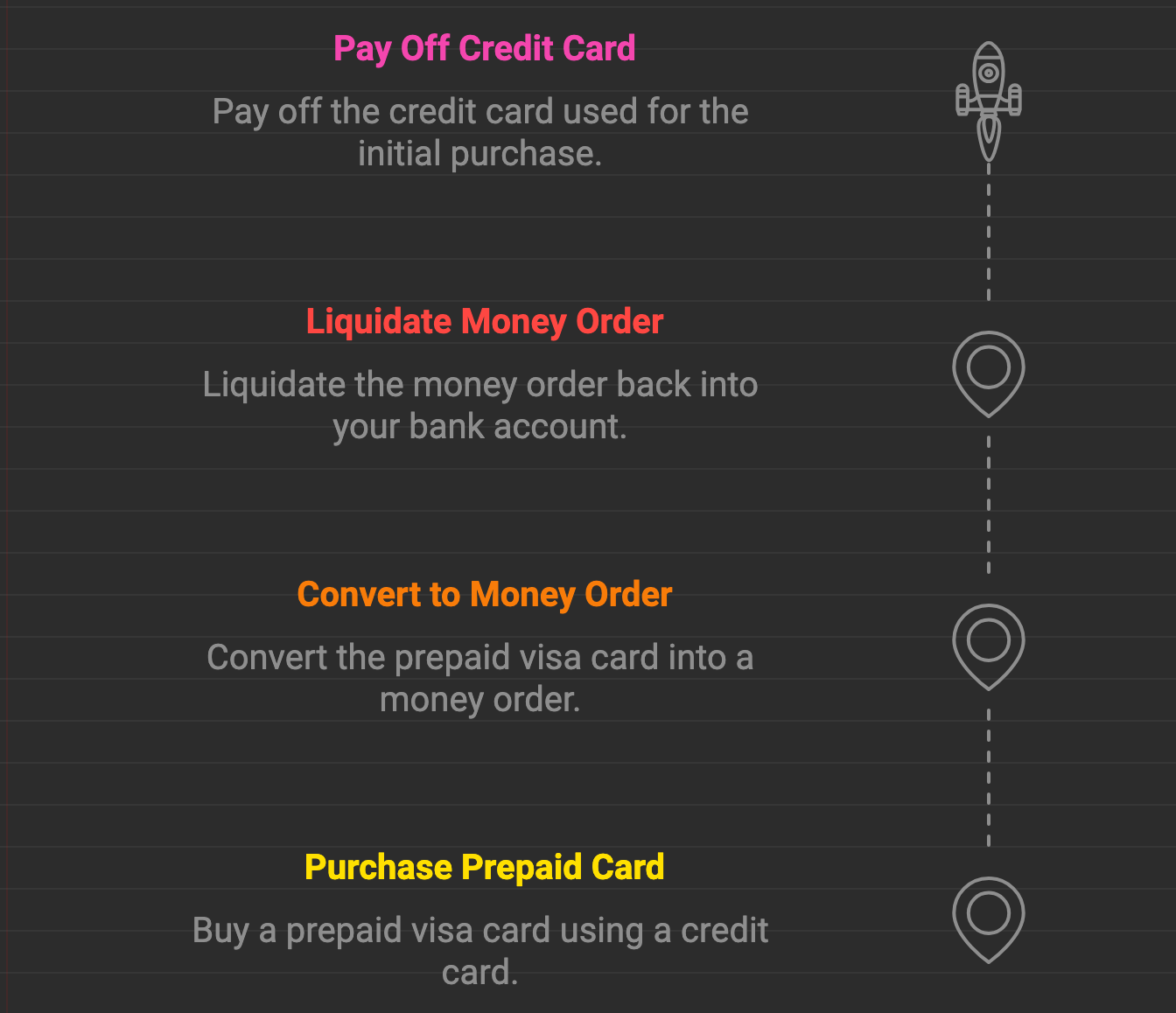

The simplest example is prepaid visa gift cards. There are forum talks on Flyertalk and other forums discussing datapoints, but all you need to know is:

You can buy a Visa gift card in store using your credit card. (Sometimes stores even hold promotions waiving the activation fee, or maybe the SUB for your card makes this worth it).

Buy a Money Order using the gift card. A money order is essentially a “check” that you can get at certain grocery stores / delivery stores using the prepaid visa card

Deposit the money order into your bank account and pay off your credit card

Buying Groups

Another popular way to generate points are buying groups. Essentially some stores will limit merchandise per user, and so there are groups who are willing to buy at cost or at a bit of profit to you for you to buy the item for them and ship to them. There some big ones out there but the concepts remain the same:

The buying group put out an item + the store to buy + the acquisition cost for you / what they will pay you

You buy using your credit card, meaning you usually will have some margin of your own built in here.

You ship the item to the buying group

You wait for the buying group to pay you out

You pay off your credit card

This also extends to other communities such as Costco Gold Buying groups, where there are buying groups for gold, so you can sell gold to them.

What are the things to look out for in a Manufactured Spending (MS) method?

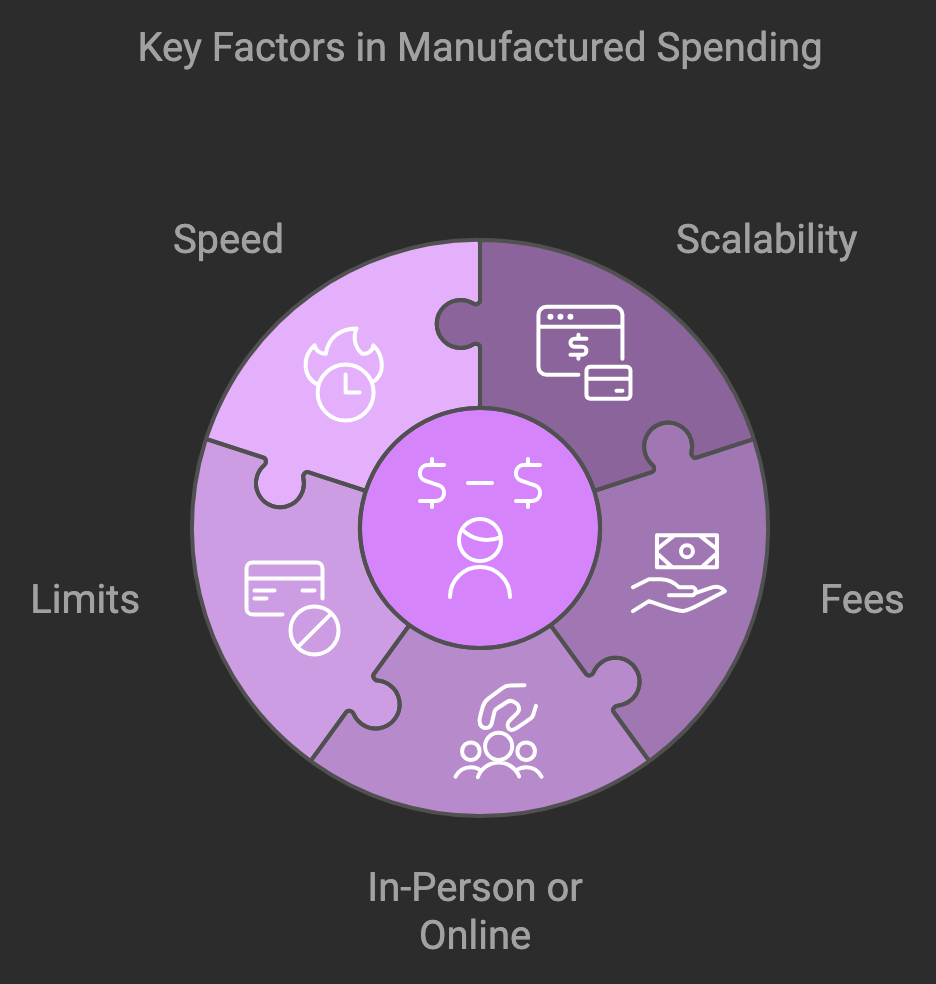

Scalability: You want to be able to do 10Ks, if not 100Ks through the method. While there are smaller plays here and there, being able to do more with your method means more money in your pocket

Fees: You want to reduce the amount of fees for a method. Every method has a cost, and you’ll need to know are you in the positive or negative, and what are you getting out of it.

In-Person or Online (“Couch Sitting”)

Limits: Always read the terms and conditions, and always understand how it will affect you. There are some nuances such as maybe a card will only give you up to 10K in spend cashback. Maybe some cards have other requirements, and let you only spend 1K a month, so on.

Speed: I personally always am looking for the fastest method possible. But some strategies might take longer to play out, for example sports betting arbitrage (which might be covered in a future article) can be something that pays out lucratively, but maybe you need to do that over the course of a year. Versus maybe credit cards, will pay out at the end of your credit card statement. So there is always a range of speeds to consider too.

Note!!:

The method I advocate for later in the series does take about 1 month to get approved and setup. While there are other things you can do in the mean time, the reality is that to get into this hobby does take a bit of time.

Thus… Conclusion!

You have now learnt the first thing about manufactured spending. Let’s move onto the next article which will discuss the method I recommend, a high level overview of that method, how to get set up, and then a detailed deep dive!

Such a great doc to follow and start my journey

Would be good to add where fluz falls here. otherwise great article!