Which 2% Cash Back Credit Card Is Right for You? And how to get even 3%+ back on some of them!

2% Cash Back Credit Card Comparison Guide + how to get even more %s out with manufactured spending.

If you're looking for a credit card that gives you solid rewards on everyday spending, then a 2% cash back card might be just what you need. Not only do these cards offer simple, unlimited cash back on all your purchases, but some also come with attractive sign-up bonuses.

There are also a few cards in this list that can be paid off with special debit cards for even more cash-back resulting in above a 3% return!

Let's dive into a few top options, compare their benefits, and help you pick the best one for your needs. At the end of this article, you’ll find a comparison table I’ve put together to help you easily choose the card that best fits your needs!

Featured Cards (Sorted by Sign-Up Bonus)

PNC Cash Unlimited® Visa® Credit Card

Sign-Up Bonus: $250 (Spend $1,000 in the first 3 months)

Cash Back: Unlimited 2% on all purchases

Annual Fee: $0

Foreign Transaction Fees: None

Notes: Available only in select states like Pennsylvania, Ohio, and others.

Citi® Double Cash Card

Sign-Up Bonus: $200 (Earn 20,000 ThankYou® Points by spending $1,500 in the first 6 months)

Cash Back: 2x ThankYou Points (1x when you buy, 1x when you pay off your purchase)

Annual Fee: $0

Foreign Transaction Fees: Yes

Notes: Citi’s 8/65 Rule applies—only one Citi card every 8 days and two every 65 days.

Wells Fargo Active Cash® Card

Sign-Up Bonus: $200 (Spend $1,000 in the first 3 months)

Cash Back: Unlimited 2% on all purchases

Annual Fee: $0

Foreign Transaction Fees: Yes

Notes: Get up to $600 in cell phone protection if you pay your phone bill with this card.

Fidelity® Rewards Visa Signature® Card

Sign-Up Bonus: $100 (Spend $1,000 in the first 3 months)

Cash Back: Unlimited 2% on all purchases

Annual Fee: $0

Foreign Transaction Fees: None

Notes: Best suited for Fidelity investment account holders.

SoFi Credit Card

Sign-Up Bonus: None

Cash Back: 2.2% on all purchases (2% standard, extra 0.2% with SoFi Checking and direct deposit)

Annual Fee: $0

Foreign Transaction Fees: None

Notes: Includes cell phone protection up to $800 per claim, $1,000 per year.

Bread® Cashback American Express® Credit Card

Sign-Up Bonus: None

Cash Back: Unlimited 2% on all purchases

Annual Fee: $0

Foreign Transaction Fees: None

Notes: Issued by Comenity Capital Bank, not counted toward the AmEx card limit.

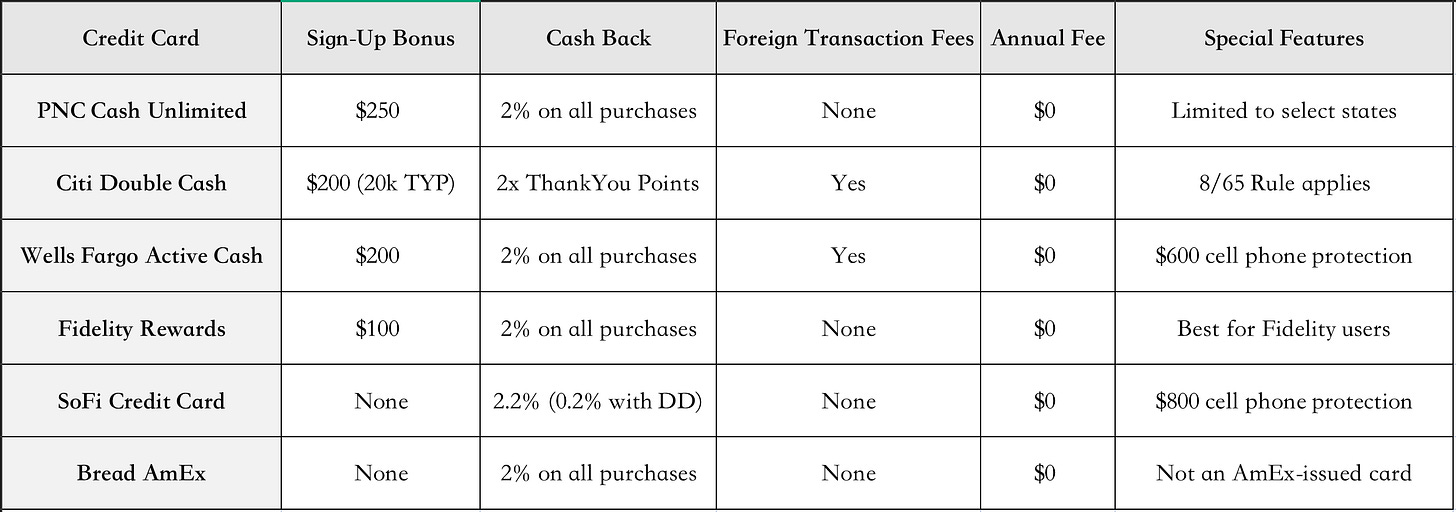

Comparison Table

Conclusion

Each of these cards offers at least 2% cash back with no annual fee, making them a great option for maximizing rewards. Depending on your spending habits and what perks you're looking for, you can find a card that fits your needs. For example, the PNC Cash Unlimited gives the highest sign-up bonus, while the SoFi Credit Card offers a higher 2.2% cash back when paired with SoFi Checking.

Stay tuned for more Money Maker tips and tricks on how to maximize your cash back and earn rewards efficiently!

Manufactured Spending Targets:

Look to our Discord for a complete rate breakdown, but there are 3 cards here that are specifically able to be targeted using the special debit card in order to get even more percentages out.