Why Checking Account Bonuses Are Your Best Kept Secret for Extra Cash

Everything You Need to Know Before You Start Earning Big with Checking Account Bonuses

If you’re looking for a low-risk way to make extra money, checking account bonuses offer an easy solution. By strategically opening new bank accounts and meeting simple requirements, you can earn hundreds—even thousands—of dollars in bonuses with minimal effort. But like any strategy, checking account bonus hunting has both advantages and challenges:

Pros:

Almost no risk: Unlike riskier financial strategies, bonus hunting is straightforward, with little to no downside as long as you follow the bank’s terms.

No hard pull: Checking account openings generally don’t involve a hard inquiry, so they won’t affect your credit score like credit card applications do.

Repeat bonuses: Some banks allow you to earn the same bonus more than once, typically after a 12-14 month waiting period.

Multiple accounts at once: You can open several accounts simultaneously, allowing you to maximize bonuses in a short period.

Ability to save money: Many accounts require a minimum balance, helping you set aside savings while earning rewards. Some banks also offer additional perks like cash back on purchases or a competitive APY (Annual Percentage Yield) on your balance, allowing you to grow your money while qualifying for the bonus.

Cons:

Requires careful management: Keeping track of multiple accounts, timelines, and bonus conditions requires organization. Without it, you risk missing deadlines or incurring fees.

Understanding bank restrictions: Each bank has specific rules, and following them closely is key to successfully earning bonuses.

Taxable income: Bonuses are considered taxable and will need to be reported on your tax return.

Time and effort: Although the potential earnings are high, it does take time and effort to manage multiple accounts and meet all the requirements.

With these pros and cons in mind, this article will guide you through the basics of checking account bonuses, answering your key questions so you can start earning without the stress. In future articles, we’ll share timelines and strategies for earning up to $2,000+ in 3 months and managing multiple accounts efficiently.

Now that you understand the potential benefits and challenges of checking account bonus hunting, let’s dive into some common questions to help you get started. Whether you're a beginner or looking to refine your strategy, these answers will provide a solid foundation for maximizing your earnings.

1. What is Checking Account Bonus Hunting?

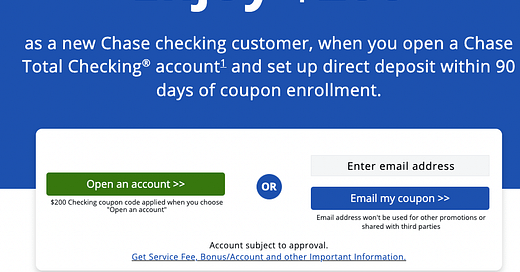

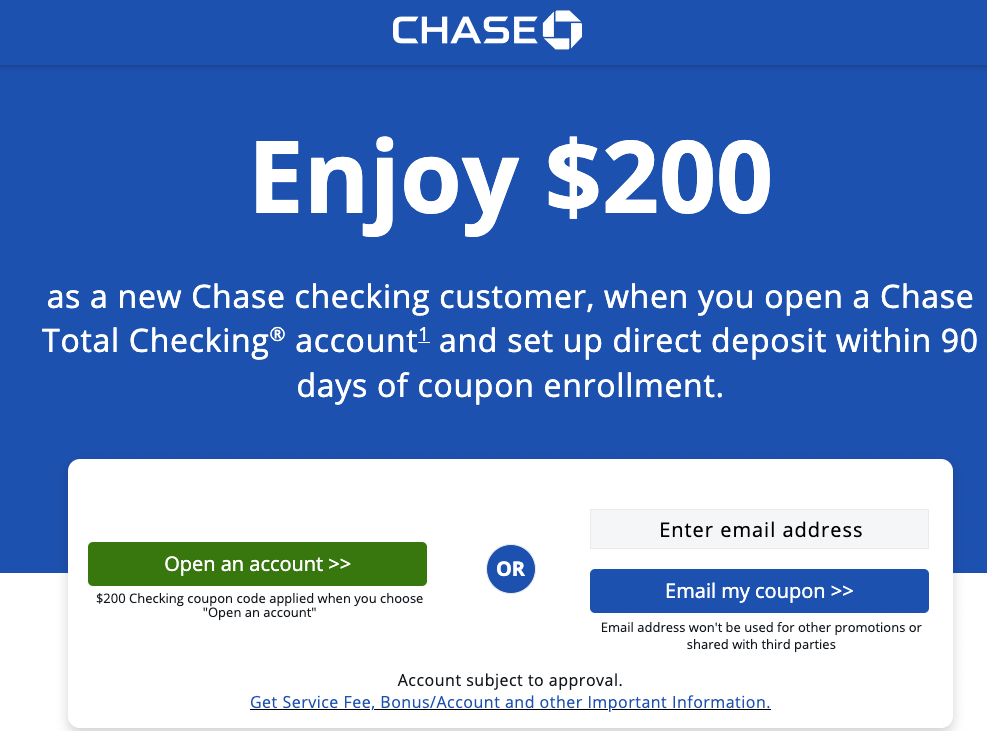

Checking account bonus hunting is a strategy where you open new checking accounts to take advantage of the sign-up bonuses that banks offer. These bonuses often range from $200 to $400 per account, and they come with specific requirements like setting up direct deposits or making debit card transactions. The idea is to earn these bonuses with as little effort and cost as possible, while cycling through different banks to maximize your rewards.

In future articles, we’ll provide timelines and strategies to help you earn $2,000+ in just 3 months by smartly navigating these bonuses.

2. Can I Close a Checking Account After Receiving the Bonus?

Yes, but timing is key. Most banks require you to keep the account open for at least 180 days before closing it. If you close the account too soon, you risk having the bonus clawed back. Each bank has its own rules, so be sure to check their terms before closing the account. In upcoming posts, we’ll provide a list of banks and their specific closing requirements to help you avoid any unpleasant surprises.

3. Can I Reopen a Checking Account to Get the Bonus Again?

Reopening an account is possible with many banks, but they usually require you to wait 12 to 24 months before you’re eligible for another bonus. Some banks may allow you to receive the bonus multiple times, while others limit it to once per lifetime. We’ll cover the exact policies for different banks and how you can reapply strategically in future articles.

4. What Are the Common Requirements for Earning a Checking Account Bonus?

The most common requirements include:

Direct Deposit (DD): Many banks require you to set up direct deposits within a set period after opening the account.

Minimum Balance: Some banks need you to maintain a specific balance for a certain period.

Debit Card Transactions: You may need to make a certain number of debit card transactions.

Account Activity: Regular activity, such as deposits or withdrawals, might be required to avoid fees.

Direct deposit requirements can vary widely between banks. Some are more lenient and allow transfers from PayPal or Venmo, while others require payroll or government deposits. In future articles, we’ll explain the different types of direct deposits and even provide tips on how to set up fake DDs to meet these conditions easily.

5. How Can I Avoid Fees on These Accounts?

Most checking accounts come with monthly fees, but these can often be waived if you meet certain conditions, such as maintaining a minimum balance or making direct deposits. Every bank has different fee waiver rules, so it’s crucial to understand how to avoid charges before signing up. In upcoming posts, we’ll share how to manage these fee requirements and keep your accounts cost-free while earning those bonuses.

6. How Many Checking Accounts Can I Open?

There’s no official limit to how many checking accounts you can open, but managing multiple accounts requires careful planning. Opening too many accounts too quickly could raise concerns with banks, potentially triggering security flags or even leading to account closures. Additionally, banks may limit how often you can open new accounts or qualify for bonuses.

For beginners, it’s best to start by opening one or two accounts at a time, making sure you meet all the bonus requirements before moving on to more. As you gain experience and confidence, you can gradually scale up to managing several accounts simultaneously.

It’s important to keep track of each account's requirements, timelines, and fee waivers to avoid missing out on bonuses or incurring fees. In future articles, we’ll provide tools and strategies to help you organize and manage multiple accounts efficiently, so you can maximize your rewards without the stress.

7. Are Checking Account Bonuses Taxable?

Yes, checking account bonuses are considered taxable income, and banks usually send out a 1099-INT form if the bonus exceeds $10. Be sure to report this income on your tax return. While it may slightly reduce your earnings, it’s still a lucrative opportunity. Stay tuned for more tips on how to handle tax reporting for bonuses and how to minimize your tax liability.

By now, you should have a solid understanding of how checking account bonuses work and why they’re such an easy way to earn extra cash. In our next article, we’ll walk you through specific strategies, timelines, and examples to help you earn over $2,000 in just 3 months. We’ll take you step by step through different banks, their requirements, and tips for maximizing your earnings.